What I’m about to share with you is really important. We could all use a little money saving every month, right? How about tons of money? Well, keep reading to see 10 painless ways that you can save tons of money every month.

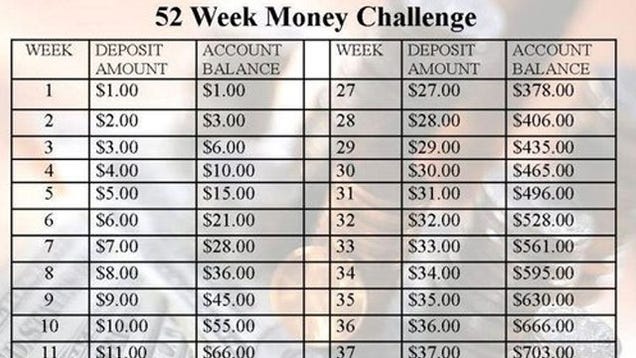

1. Try the 52-week challenge. Yep, there are 52 weeks in the year, but that doesn’t mean it has to be a new year before you start this one. This one is so painless you won’t even feel it. All you have to do is commit to put away the same amount of money as which week it is. So for week one, save $1. Week two, save $2, and so on. Keep doing this every single week until you save $52 at week 52. By that point, you will have saved over $1300. See, pretty painless!

2. Cut the cable. This really is less painless than you might think, because with the services of streaming providers like Netflix and Hulu you can still catch the TV shows you want for a nominal monthly fee that is much MUCH cheaper than cable. For a guide on cable TV alternatives, see Tom’s Guide.

3. Try earning money every month on all your online purchases! You can join Ebates for free, it’s easy to use, and you’ll earn up to 40% cash back on every online purchase you make. {Including Amazon!}

4. Make your coffee at home instead of buying from the coffee shop every morning. Check out She Knows for some delicious homemade coffee recipes. If you spend an average of $3 each day on Starbucks, multiply that by an average of 28 days, and you’ll save at least $84 each month.

5. You can save a lot of money every month if you cut down the number of times you eat out for lunch. Here are some great brown bag lunch ideas so you won’t even miss eating out!

6. If you always buy name brand items at the grocer’s, try substituting store brands instead. Many of them are just as good. For a helpful guide as to which store brands are as good as their name brand counterparts, see this report on a taste-off done by Consumer Reports.

7. Don’t buy bottled water! It’s not worth it when you can get a refillable bottle and refill it at home, the office, or pretty much wherever you are with virtually no trouble.

8. Do you still have a landline? Consider getting rid of it. If you’re paying a cell phone bill every month, there really isn’t much reason to pay for both. Plus, there are some good alternatives to a landline that will save you money if you feel that a landline is something you need.

9. Believe it or not, driving more efficiently and keeping up with proper tire pressure saves you on the fuel costs of driving your car.

10. Save money by actually utilizing your city library. Even if you read from a Kindle, you can rent ebooks from your library instead of buying. See PT Money for five ways the library can save you money.

Leave a Reply